- About

- Community

- Israel

-

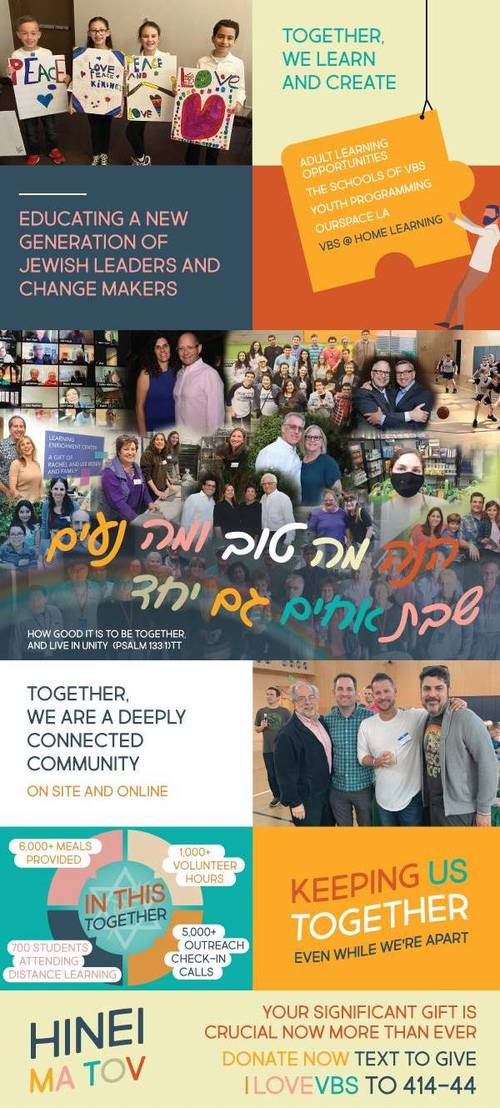

Learn

- Our Schools

- Youth Department

- B'nai Mitzvah Program

-

Adult Learning

- Hazak

- Sayva: A New Approach to Positive Aging

- EFSHAR presents The Mystical Journey: A Month of Learning

- Talking Torah with Rabbi Lebovitz

- Weekly Torah Study with Rabbi Feinstein

- Thinking Aloud with Rabbi Nolan Lebovitz

- Discovery Circle

- VBS College of Jewish Studies

- Miller Introduction to Judaism (AJU) at VBS

- VBS Book Club

- Lunch and Learn

- The Inner Life of Men

- Adult B'nai Mitzvah Program

- OurSpace: The Artistic Spectrum of Jewish Learning for Adults

- Melton School

- Harold M. Schulweis Institute

- VBS YouTube Video Archives

- VBS Digital Media Projects

- Pray

- Volunteer

- Join

- Donate

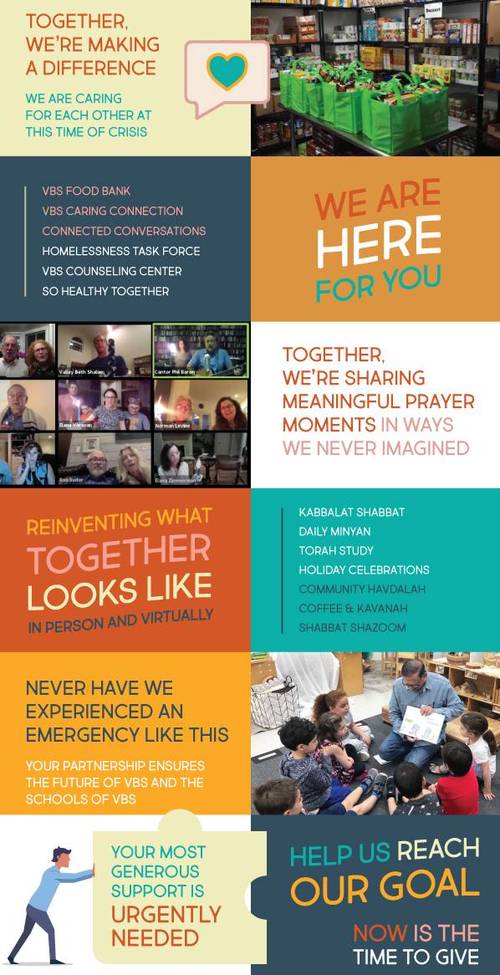

Year End Giving 2020

Year End Giving

Benefit by Giving at Year End

Why should I give?

Due to the ongoing Coronavirus crisis, VBS needs your support. Every year, VBS depends on your contribution to the Annual Campaign to keep our vibrant community growing and thriving. This year, the Annual Campaign is an Emergency Campaign. It has one purpose - to keep children in our schools and families in our synagogue. If you have never contributed to our Annual Campaign, this is the year to begin! While we have been successful in raising funds and are moving toward our goals, we still need VBS-wide participation to get there. Help us reach our goal!

A gift to VBS may result in tax benefits:

A gift to VBS may result in tax benefits:

- Charitable deductions on your current income tax return and capital gains tax savings are a foremost benefit.

- NEW FOR 2020 ONLY– Under the CARES Act, individuals who don't otherwise itemize, can claim a tax deduction of up to $300 per individual for donations to entities like VBS. Consult your tax advisor.

When should I give?

If you complete your gift by December 31, 2020, your gift can be tax-deductible this year.

What should I give?

Giving several types of gifts is still possible this calendar year - and practical for many donors.

- Gifts of cash

- Gifts of securities

- Legacy Gifts

- Donate your vehicle

As a synagogue, our revenues have been deeply affected this year. Much of that lost revenue can only be made up by the generosity of you, our dedicated members. We are asking you to consider giving a little more this year -- if you can. If you have already given this year, THANK YOU. If you are able, we are asking you to consider giving a little more. Giving is not just about making a donation, it's about making a difference.

Valley Beth Shalom is a non-profit, tax exempt 501(c)(3) organization

|

Tue, July 8 2025

12 Tammuz 5785

Your gift is crucial now, more than ever. Thank you!